Your Options Trading Copilot

Options AI helps traders discover opportunity and make better decisions with the power of visualization and intelligent automation.

Then only $19/month. Cancel anytime.

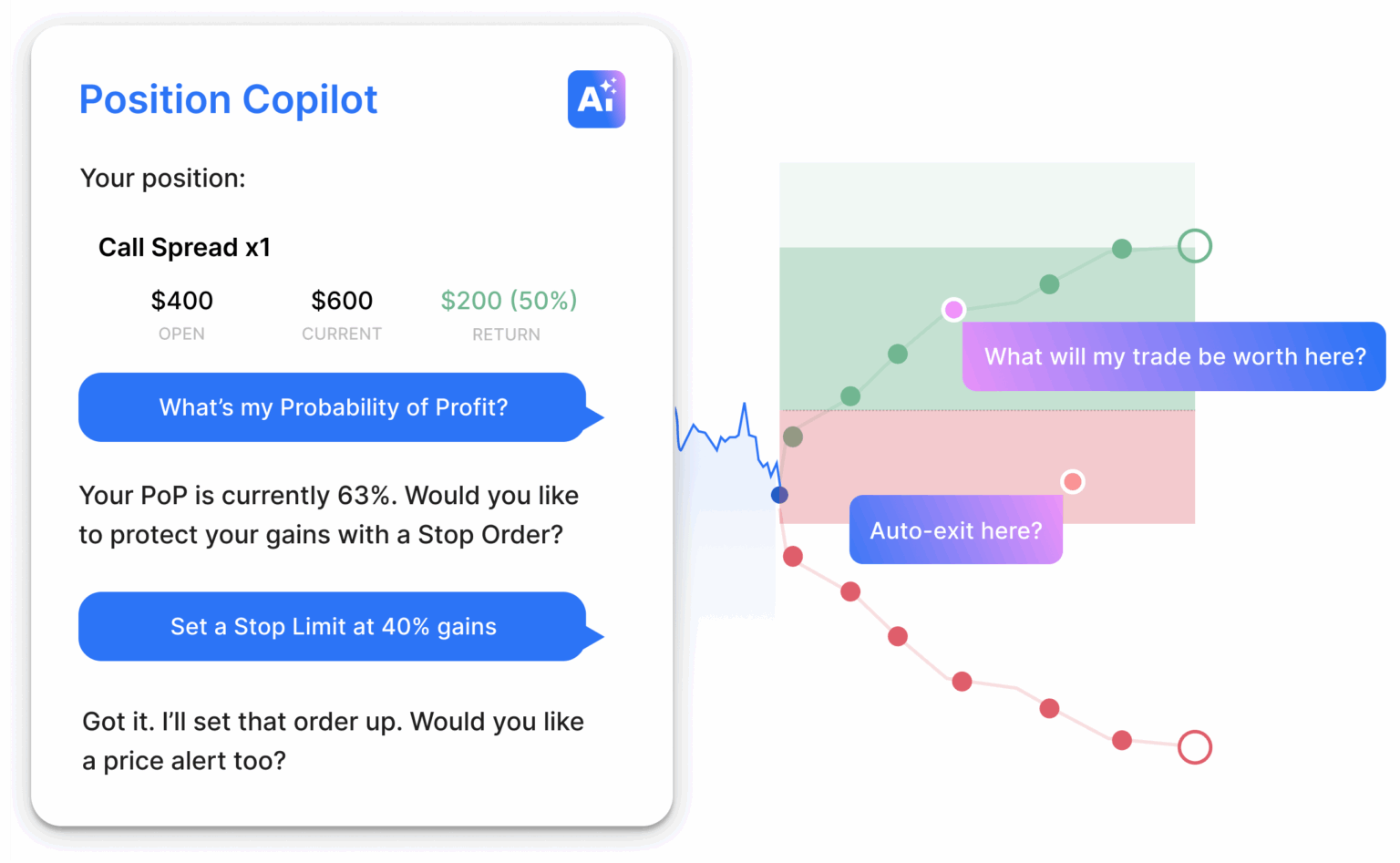

Position Copilot

Turn every trade into a superhuman trade with the first AI-powered chat assistant for position management. Helping you unlock opportunity with every move.

What-If Simulator

Imagine knowing what your trade might be worth tomorrow...or next week? Plan smarter entry and exit points with our intuitive options profit calculator.

QuickStrike Trades

Turn your view into trades in seconds. Our patented system uses the expected move to let you generate and compare everything from calls to credit spreads with a click.

QuickStrike Trade

Find the right trade in seconds. The Options AI patented system uses the expected move to instantly generate strategies – letting you compare and customize everything from calls to credit spreads with a click.

US Patent No’s: 11,908,007 and 12,205,169

Visualize expected moves for 0DTE and beyond

Use real-time expected moves to spot opportunity and for fast spread-trade setup.

Options profit calculator and what-if simulator

Test trade ideas and pick better entry or exit points right from a chart.

Forget old-fashioned payout diagrams

Options AI makes spreads as simple as zones of profit and loss on a price chart – so anyone can enjoy the power of advanced trading.

Real-time visual trade management and trade alerts.

All the tools to help you plan your exit and get the most from every options trade.

FAQ

What is Visual Trading?

Options AI puts the Expected Move at the heart of its visual platform – so you don’t just see what a stock has done, but what the market thinks it will do next.

You can then use that Expected Move chart to:

- See the crowd consensus on upcoming price moves

- Setup and visually compare option strategies using the expected move for initial strike selection

- Test your option trade before executing by using visually simulating potential outcomes

- Manage your trade on the same expected move chart to make smater decisions on when to exit

Is paper trading included in my trial?

Yes. During your 10 day trial, you’ll have full access to the Options AI platform and all the tools, including visual strategy setup, the ‘what-if’ trade simulator, virtual portfolio and trade manager, as well as access to our team of options experts to answer any questions you may have.

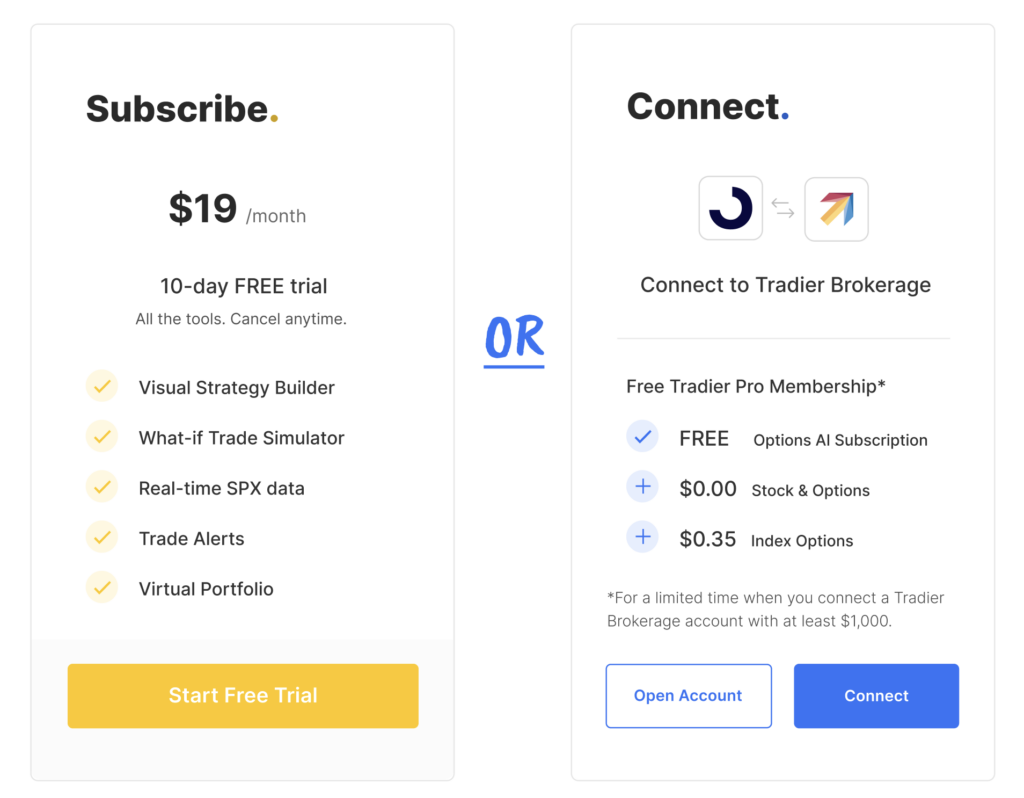

How much does Options AI cost?

$19 per month after an initial 10 day free trial. An annual subscription offers a discount of over 20% when you make a payment of $180 upfront.

We’ve intentionally kept the price as low as possible so everyone can enjoy better tools with high quality data.

Do you offer a free trial?

Yes, you can try out Options AI for 10 days for free. Your subscription is billed after the trial period.

What is the expected move?

The Expected Move (or Implied Move) is the amount that a stock or index is expected to move up or down from its current price in any given timeframe, as derived from option prices.

The Expected Move might also be viewed as the consensus of the options trading crowd. A projection of how much the market thinks a stock may move based on expectations of risk (volatility) over a given timeframe.

Why is the Expected Move useful?

The Expected Move can help traders in three key ways:

- Estimating potential price moves

- Identifying volatility around upcoming events

- Finding strategies with higher probability of profit

How do I execute trades via Options AI?

You can execute trades by connecting your Tradier brokerage account. Login to Options AI and view your account page to authorize the connection.

If you deposit $1,000 or more, Tradier will offer you commission free trading. Terms and conditions apply. Apply for a Tradier account here.

I have an idea or feedback. Who can I talk to?

Please email support@options.ai and you will be connected with the right person ASAP. We love ideas and feedback!

Start Your 10 day trial

Discover trades to boost returns and reduce risk with the power of visual trading.

Access Industry Leading Options Experts

We built Options AI because we believe that everyday traders should have the same straightforward access to advanced options strategies as the largest institutional investors. As a team with over 20 years of options trading experience, we’re on a mission to make smarter options trades more accessible and enjoyable for everyone. That’s why you don’t just get powerfully simple tech, you get our team of options experts to help teach you the tricks of the trades.

Client Testimonials

Testimonials may not be representative of the experience of other customers.

Not a guarantee of future performance or success.

In The Press

Options AI is not a broker dealer or investment adviser. It does not provide investment, tax or legal advice and does not endorse or recommend the purchase or sale of any particular security or trading strategy.

Certain features of the Options AI website (“Website”) and the service (“Service”) include charts and interactive tools designed to generate and display amongst other things: (a) past performance data; (b) future price and outcome expectations derived from options market data; and, (c) potential stock and options trading strategies based upon your personal inputs. These features and all of their content are meant for informational and reference purposes only and are not intended to serve as a recommendation to buy or sell any security or to utilize any particular trading strategy. They are also not research reports, do not reflect the opinions or expectations of Option AI and should not be considered as a basis for judging future trends or as an indication of future results. Any data or information regarding the likelihood of various investment outcomes is hypothetical in nature, is not guaranteed for accuracy or completeness, does not reflect actual investment results and is not a guarantee of future results.

The Website may include certain features provided solely to demonstrate tools and other Content that are part of the Service available only to Customers of Options AI. Demo features are intended for informational purposes only and should not be used as the basis for making investment decisions or for any other purpose. Demo features use delayed or static data and Options AI makes no warranty whatsoever as to their accuracy or usefulness.

You alone are responsible for evaluating the merits and risks associated with use of the Website and the Service and for determining whether its features and tools are suitable for you. You are also solely responsible for your personal inputs, for evaluating all information and for any investment decision you make, whether or not such decision derives from your use of the Service. Please review our full Terms of Service.

All investments involve risk and all investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and customers may lose money, including their original investment. Any investment or trade made using the Options AI Service is at your sole discretion and risk.

Online trading involves risks due to loss of online services, system response time, execution price, trading volumes, market conditions, erroneous or unavailable market data and other factors.

Options transactions may involve a high degree of risk and may expose investors to potentially significant losses and therefore are not suitable for all investors. Prior to deciding to invest in options please review the Characteristics and Risks of Standardized Options.

You can read our Privacy Policy here.